What begins as a merchant bank eventually becomes active in mergers and acquisitions, including hostile takeovers and corporate raids with junk bonds. The big trusts form and then dissolve during the days of trust-busting. Their operations change as the world changes. The London office is known as Morgan Grenfell.

Morgan Bank eventually merges with Guaranty Trust to become Morgan Guaranty. Morgan and Company in New York which splits into the Morgan Bank and Morgan Stanley when the Glass-Steagall Act is enacted. The Morgans still function as intermediaries for governments.Ĭhernow follows the path of the major Morgan operations. The outbreak of World War II brings about changes since the banks can no longer muster the resources needed to finance wars. The Morgans are always able to put together syndicates to raise loans for important parties. The Morgan role in the Latin American debt crises is told in detail from the initial loans through the repudiation and write-off of the debt on the advice of President George W. Morgan personnel function as financiers to Japan and to Mussolini. This causes problems up until the outbreak of World War II. In the post-war period, the German reparations to the Allies are used by the Allies to pay their war debts. The House of Morgan is a major financier of World War I.

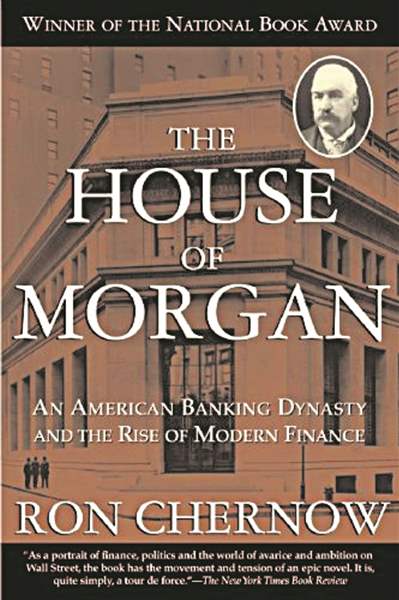

In the days before a central bank or the Federal Reserve System, the House of Morgan fulfilled many of the roles of a central bank arranging for money for governments' use. Morgan would intervene to keep the stock market open or to negotiate deals in different countries to supply gold to keep the world currency markets open and the pound and dollar stable. For many years, they are more powerful than most governments who, up until the time of World War II have to rely on private bankers to finance their wars. The House of Morgan is the banker for royalty and nations, including the Vatican. This is the bank that becomes the House of Morgan, an international banking empire.Ĭhernow tells the history of the House of Morgan, basically the history of the financial world. Morgan is upset because Peabody is a well-respected name in the banking world. When Peabody retires, Morgan has the business but cannot use the Peabody name. It explains how George Peabody opens the company called George Peabody and Company and, since he has no heirs, brings in Junius Morgan as a partner in 1854. The House of Morgan by Ron Chernow is a well-written and very interesting history of the Morgan banking dynasty.

0 kommentar(er)

0 kommentar(er)